Looking for a startup business loan? In this article we will do a deep dive into the depths of startup funding and alternative sources of non dilutive growth capital.

Starting a new business is an exciting and challenging undertaking. One of the key areas that entrepreneurs need to consider is finance.

From sourcing funding to developing a budget and managing cash flow, there are many important aspects to consider.

In this article, we will explore the various sources of funding available to startups, the importance of financial planning and management, and the legal and regulatory considerations that must be taken into account.

We will also discuss best practices for building a strong financial foundation for your business.

Whether you are just starting out or looking to grow your existing business, this guide will provide you with the knowledge and tools you need to succeed.

If you are looking to start a new business venture or kick off a new startup then you may need a startup business loan to help you start.

At Cockatoo, we understand the need for startup funding because we are one and utilised startup loans to get us up and running.

While we are early in our startup journey we have helped thousands of Australian businesses at different stages of the startup lifecycle secure funding to grow their business.

Introduction to startups

What can lead to founders needing capital

Non dilutive growth capital

Starting a startup and managing its finances can indeed be a challenging endeavor, often accompanied by significant stress.

Founders are typically focused on building and growing their businesses, leaving them with limited time and energy to balance the books let alone advanced financial management.

The strain of this responsibility can spill over into their personal lives, affecting their mental and physical well-being.

I know first hand how this can impact family life and be a source of great relationship drama.

The financial pressure faced by founders can impact their home life as they may find it difficult to strike a healthy work-life balance.

Like being so tired from the day to day operations of running a startup that you just want to curl up in a ball and watch Netflix until tomorrow.

Long hours, constant decision-making, and financial uncertainties can lead to increased stress and tension within relationships.

The demanding nature of running a startup may leave founders with less time for their families and loved ones, causing strains in personal relationships.

Mental health can also be affected due to the constant financial challenges faced by startups.

The weight of financial responsibilities, such as securing funding, meeting payroll, and managing cash flow, can contribute to anxiety, depression, and other mental health issues. The fear of failure and the pressure to succeed can further exacerbate these challenges.

Physical health can suffer as well. The stress and demanding nature of financial management in a startup can lead to sleep deprivation, poor eating habits, and a lack of exercise.

Neglecting one’s physical health can have long-term consequences and hinder overall well-being.

While it’s crucial for startups to manage their finances effectively, founders must also be cautious about diluting their equity too early in the journey.

Dilution can impact their ownership and control over the company, potentially limiting their ability to make strategic decisions or secure future funding.

Exploring options like business loans to buffer out income from customers can be a viable solution. It allows founders to maintain control over their equity while ensuring a steady cash flow to support their personal and business needs.

It’s essential to carefully assess the deal terms, interest rates, and repayment schedules to avoid taking on excessive debt that could further burden the startup.

The financial challenges faced by startup founders can have significant impacts on their personal lives, mental health, and physical well-being.

Striking a balance between managing finances and maintaining personal well-being is crucial.

Seeking support, delegating tasks, and exploring financing options that preserve equity can help founders navigate the complexities of startup finance while safeguarding their overall well-being.

Focus on sound financials first so that you are in a good position to not only track your runway but also so you can borrow

Invest in bookkeeping and accounting from the outset and focus on profit first

Don’t leave money last make it a part of your daily routine

The mental stress and pressure experienced by startup founders can have a significant impact on their decision-making abilities, particularly in the realm of finance.

The strain of managing finances, coupled with the weight of responsibility, can impair their judgment and lead to poor decision-making, which can ultimately hinder the progress of the business and create negative outcomes for various stakeholders.

When founders are overwhelmed by financial pressures, they may make impulsive or shortsighted decisions without thoroughly assessing the potential risks and long-term consequences.

They might prioritize short-term gains over sustainable growth or fail to consider alternative financial strategies that could benefit the company in the long run.

Poor financial decision-making can manifest in various ways.

For instance, founders may take on excessive debt without a clear plan for repayment, resulting in a heavy financial burden that stifles growth and limits the company’s flexibility.

They may also overlook the importance of building a cash reserve or contingency fund, leaving the business vulnerable to unexpected downturns or emergencies.

The constant pressure to raise funds quickly or secure financing can lead to hasty decisions about equity distribution or investment terms.

Founders may end up diluting their ownership excessively or accepting unfavorable deals that limit their control or undermine the company’s value.

These poor financial decisions can have far-reaching consequences for individuals, employees, shareholders, and the overall health of the business.

Financial mismanagement can strain relationships with investors, erode trust, and make it more challenging to secure future funding.

It can also result in cash flow problems, leading to delayed payments to employees, suppliers, or service providers, which can damage the company’s reputation and employee morale.

Poor financial decision-making can hinder the business’s ability to invest in crucial areas such as research and development, marketing, or talent acquisition.

This can impede growth opportunities, innovation, and competitiveness in the market.

In some cases, financial mismanagement can even lead to the ultimate failure of the startup, causing financial loss for founders, employees, and investors alike.

To reduce the risk to founders and the associated mental stress healthy financial activities should be a part of day to day operations.

Seeking support, consulting with experienced advisors or mentors, and prioritising mental well-being can help founders maintain clarity and make informed decisions regarding the financial aspects of their startup.

By fostering a healthy balance between managing the business’s finances and maintaining personal well-being, founders can enhance their decision-making capabilities, promote sustainable growth, and create positive outcomes for all stakeholders involved.

A startup is a company or organization that is in the initial stages of operation.

These companies are typically small and are often founded by entrepreneurs or business people who are looking to develop a new product or service.

The goal of a startup is typically to grow quickly and establish itself as a successful business.

This can involve developing a unique product or service, building a customer base, and generating revenue.

Because they are in the early stages of operation, startups often face a high degree of uncertainty and risk.

You will likely know if you are a startup business but for those that are wondering a startup is a company that’s in the early stages of business.

These are generally businesses that include one or more founders building a product or service to take to market.

Startup businesses may need loans for a variety of reasons.

Starting a business typically requires a significant amount of capital, and many startups do not have enough money saved up or access to other forms of funding, such as venture capital or angel investors.

A loan can provide the capital that a startup needs to get off the ground and start operating.

Business loans for start ups can help a startup to finance the purchase of equipment, inventory, or other assets that are necessary for the business to function.

Finally, a loan can provide a startup with working capital to cover a range of different business operations activities such as:

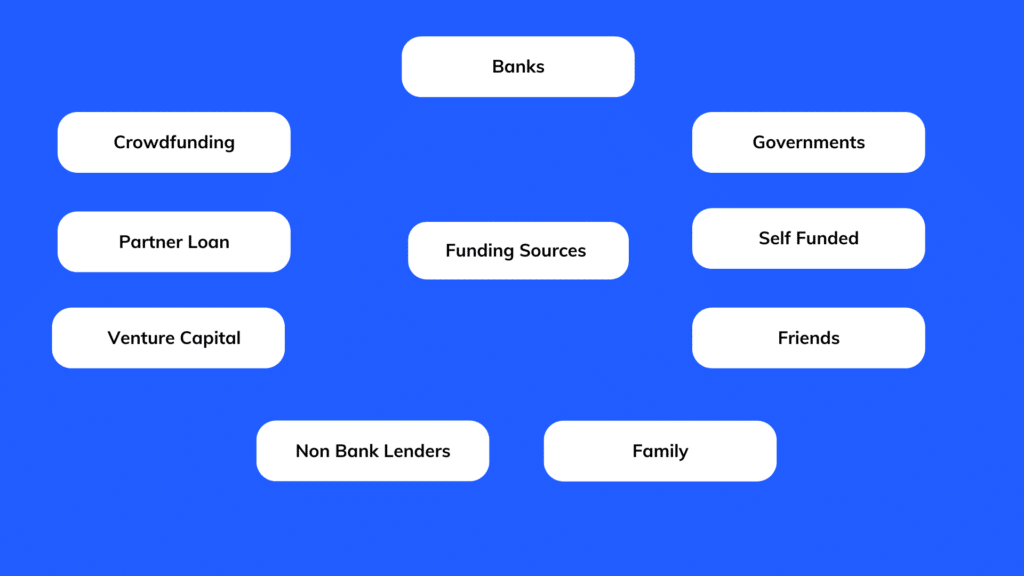

There are a number of different funding sources that startups can use to finance their operations.

Most startups will start with founder funds also known as bootstrapping as well as potential loans from friends, family or angel investors.

Founder funds, also known as “bootstrapping,” is a term used to describe the practice of using personal funds or resources to start and grow a business, without relying on outside investors or loans.

Many entrepreneurs choose to bootstrap their businesses because it allows them to retain control over the direction of the company and avoid taking on debt.

Additionally, bootstrapping can be a good option for entrepreneurs who are unable to access traditional forms of financing, such as loans or venture capital.

The downside of bootstrapping is that it can limit the growth potential of the business, as the entrepreneur is limited to the amount of money they are able to invest personally.

It can also be a riskier approach, as the entrepreneur is personally responsible for the success or failure of the business.

Angel investment is a type of funding that is provided to startups by individual investors, known as angel investors.

Angel investors are typically high-net-worth individuals who are looking for opportunities to invest in promising startups in exchange for ownership equity.

Angel investors may provide funding at the seed stage, when a startup is just getting started, or at later stages of growth.

The amount of funding that an angel investor provides can vary, but it is typically in the range of $25,000 to $100,000.

Crowdfunding is a type of funding that is provided by a large number of people, typically through an online platform.

Startup businesses can use crowdfunding to raise money from a large number of people who are interested in their idea and want to help them get started.

In return for their investment, backers may receive rewards, such as a product or service from the business, or equity in the company.

Crowdfunding can be a good option for startups that want to raise money quickly and easily, without giving up control of the company.

It can also be a useful way to validate an idea and test market demand.

However, crowdfunding can also be a risky approach, as there is no guarantee that the business will be able to raise the funds it needs.

Venture capital is a type of funding that is provided to startups by venture capital firms.

Venture capital firms are investment companies that provide capital to promising startups in exchange for ownership equity.

They typically invest in companies that have high growth potential and are at an early stage of development.

The amount of funding that a venture capital firm provides can vary, but it is typically in the range of several hundred thousand dollars to several million dollars.

Venture capital can be a good option for startups that are looking for significant funding and are willing to give up a portion of ownership in the company.

However, it can also be a competitive and challenging process, as venture capital firms are selective about the companies they invest in.

These are the most common sources of funding for startups and is how most startups will fund their startup launch.

Startups may also use more traditional forms of financing, such as loans from banks or other financial institutions, to fund their operations.

Bank loans are a common source of funding for startups.

Many banks and other financial institutions offer loans specifically designed for small businesses and startups.

These loans can provide the capital that a startup needs to get off the ground and start operating.

The terms of a startup loan, including the interest rate and repayment period, can vary depending on the lender and the specific loan product.

In order to qualify for a startup loan, the business will typically need to provide the lender with information about its operations and financial health, as well as a business plan and financial projections.

It is important to carefully compare different loan offers and choose one that is the most suitable for your needs.

As you can see from the funding sources listed above, there are points early in a Startup’s career where the type of funding that is sorted out can have a massive impact on their growth and overall success.

According to the Australian Bureau of Statistics (ABS) the total number of actively trading businesses, and rates of entry to and exit in Australia are as follows:

There are 2,569,900 actively trading businesses in the Australian economy.

In 2021-22 there was a: 7.0%, or 167,646 increase in the number of businesses, of which 140,102 are non-employing businesses.

19.7% entry rate, with 472,731 entries.

12.7% exit rate, with 305,085 exits.

This means that there are roughly 400,000 businesses entering the market every 12 months.

Congratulations if you are one of them because startup founders are a special breed.

While not all startup businesses will require funding in the form of a loan due to consistent positive cash flow.

There are many occasions when a healthy injection of positive cash flow can positively support growth.

Some start-up activities that might require better cashflow for your startup include:

– Debt Financing

– Equity or share payouts

– New hire costs

– Marketing budgets

– Infrastructure costs (AWS, Azure or GCP costs)

– Technology hardware costs

– Software and subscription costs

– Inventory and stock levels

– Equipment purchases

– Car purchase

– Heavy vehicle purchases

As a startup, you will want to make sure you have a few financial instruments at your disposal.

The first piece we always recommend is a good business bank account.

This makes sure you have the business accounts in place to manage income and expenses and can demonstrate financial acumen to the bank or non-bank lender.

The next financial tool for any ambitious startup is either a term loan or a line of credit.

This will allow you to grow with better predictability in your startup’s roadmap.

Business loans are just another tool in the arsenal of a startup founder.

It should not be the only way you found your startup it should be used in conjunction with the other tools listed above.

That being said the way most unsecured business loans work is by reviewing your cash flow.

This means you will need at least 6 months of trading on the company ABN and cashflow of $6,000 AUD in monthly revenue.

At this point, you can qualify for pre-approval and start the application process.

The most common type of startup business loan is the term loan.

A startup can get a term loan from a bank or non bank lender.

The rates and amounts varey greaty between providers but also due to the varaibility in business performance and overall profitabiliy. If you speak to a business mortgage broker you may hear them call this type of loan a cashflow loan. This is due to the fact that the lender uses the businesses cashflow as the main way to calculate the term loan size and rate.

Term loan provide a fixed amount of capital upfront. This is then paid down over time with, regular installment payments.

Getting a line of credit for a startup can be extremely helpful for day to day operations.

A line of credit as it sounds is a pool of funds of a pre agreed amount that can be drawn down by a startup founder to manage the day to day cashflow operations of their business.

Business loans are just another tool in the arsenal of a startup founder.

Business loans can be a useful source of funding for startups, but there are some situations in which making reaching for a business loan a better option the other financial vehicles.

Here are a few potential reasons why a startup might want to consider using business loans to finance its operations:

The startup has a solid business plan and can demonstrate its potential for growth and profitability.

In this case, a lender may be more willing to provide a loan because the business has a good chance of being successful and able to repay the loan.

The startup needs capital to cover short-term expenses, such as hiring employees, purchasing equipment, or marketing its products or services.

Business loans can provide the necessary funds to cover these costs, allowing the startup to continue operating while it works to generate revenue.

The startup has collateral, such as assets or equipment, that it can use to secure the loan. This can help to reduce the risk to the lender and make it more likely that the loan will be approved.

The decision to use business loans to fund a startup should be based on the specific needs and circumstances of the business.

It may be a good option if the startup has a solid business plan, needs capital to cover short-term expenses, and has collateral to secure the loan.

It should not be the only way you found your startup it should be used in conjunction with the other tools listed above.

There are a number of challenges that startups may face when it comes to funding their operations. Some of these challenges include:

Many startups struggle to access the capital they need to grow and develop their businesses. This can be because they do not have the necessary collateral to secure a loan, or because investors are not willing to take on the high risk associated with investing in a startup.

Startups may have a difficult time convincing potential investors or lenders that their business is worth funding.

This can be because they are in the early stages of development and do not have a track record of success, or because their product or service is untested and unproven.

Startups may face competition from other businesses, both within their industry and outside of it, for funding from investors and lenders. This can make it difficult for them to secure the capital they need to grow and succeed.

The failure rate for startups is high, which can make investors and lenders wary of providing funding.

This can be because many startups are unable to overcome the challenges they face, such as lack of access to capital, difficulty proving the value of their business, or competition for funding.

Overall, there are many challenges that startups may face when it comes to funding their operations. These challenges can make it difficult for them to access the capital they need to grow and succeed.

Preparing your financial statements is an important step in applying for a loan.

Financial statements provide a snapshot of your business’s financial health and are used by lenders to evaluate your creditworthiness and the potential profitability of your business.

The most common financial statements that a lender will require are:

In order to prepare your financial statements, you will need to gather your financial records, such as invoices, receipts, and bank statements.

You can then use accounting software or hire an accountant to help you organize and analyze your financial data.

It is important to make sure that your financial statements are accurate and complete, as this will help to give lenders confidence in your business and increase your chances of getting approved for a loan.

When applying for a loan, it is important to provide the lender with information about how you intend to repay the loan.

This can include your projected income and expenses, as well as details about your business plan and financial projections.

It is also a good idea to provide the lender with a detailed repayment plan, outlining how much you will pay each month and when the loan will be fully repaid.

Providing this information can help to give the lender confidence in your ability to repay the loan and increase your chances of getting approved.

It is also important to make sure that your repayment plan is realistic and achievable so that you can avoid defaulting on the loan.

If you are applying for a secured loan, you will need to provide the lender with information about the assets that you will use as collateral.

Collateral is a term used to refer to the assets that a borrower pledges as security for a loan.

If the borrower is unable to repay the loan, the lender can seize the collateral in order to recoup their losses.

Examples of assets that can be used as collateral include:

In order to show a lender that you have collateral, you will need to provide them with proof of ownership of the assets.

This can include copies of deeds or titles, as well as receipts or invoices showing the purchase price of the assets.

You will also need to provide the lender with an appraisal of the assets, which is a valuation of their worth.

This can help the lender determine how much they are willing to lend against the collateral.

It is important to make sure that the value of the collateral is sufficient to cover the amount of the loan, so that the lender is adequately protected in the event that you are unable to repay the loan.

What do you do if the banks wont fund your new business venture?

While standard startup funding road is prefered there are still options avaliable to your startup if you have been declined by a bank or non bank lender.

There are many other alternatives that you can consider but they all come with their own unique risks.

Alternative funding sources including:

These are programs that provide startups with support, resources, and mentorship to help them grow and succeed. Many incubators and accelerators also provide funding to startups in their programs.

Many governments offer grants to startups that are working in fields such as technology, sustainability, and social impact.

Startups can form partnerships with larger companies, which can provide them with funding, resources, and access to new markets.

Some startups may be able to offer their customers financing options, such as payment plans or instalments, in order to make their products or services more accessible.

Startups can also use trade credit, which is credit that is extended by suppliers or vendors to help them purchase goods or services.

Peer-to-peer (P2P) lending is a type of alternative financing that allows individuals or businesses to borrow and lend money directly, without the involvement of a traditional financial institution.

P2P lending is facilitated by online platforms that connect borrowers and lenders, who then negotiate the terms of the loan directly.

Each of these alternative funding sources has its own advantages and disadvantages, and the right option for a particular startup will depend on the specific needs of the business.

It is important for startups to carefully consider their options and choose the funding approach that is the most suitable for their needs.

To apply for a startup loan you must either approach a bank, non bank lender or mortgage broker.

You will need to provide them with business specific documents such as a bank statements, business plans, financial projections, director’s documentation.

You may also need to provide personal financial information and collateral to secure the loan.

The specific requirements will vary depending on the lender and the type of loan you are seeking.

The eligibility requirements for a startup loan will depend on the lender and the type of loan you are seeking.

Lenders will consider all factors such as your credit score, the viability of your business idea, and your ability to repay the loan.

Some lenders may require you to have a minimum amount of business experience or to meet certain industry-specific requirements.

The amount of money you can borrow for a startup loan will depend on a variety of factors, including your creditworthiness, the strength of your business plan, and the collateral you have available. Some lenders may have minimum and maximum loan amounts that they will consider.

The interest rate for a startup loan will depend on the lender, the type of loan you are seeking, and your creditworthiness. Some types of startup loans may have more favourable interest rates than others.

The repayment term for a startup loan will depend on the lender and the type of loan you are seeking. Some loans may have a fixed repayment term, while others may be more flexible. It is important to carefully consider the repayment terms of any loan before accepting it, to ensure that you will be able to make the required payments.